What Is Double-Entry Bookkeeping? A Simple Guide for Small Businesses

Content

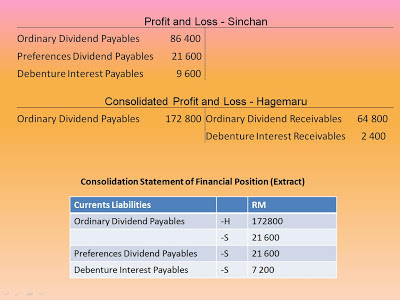

Then, once the actual invoice arrives, you would record the entry and the $10,000 expense credit would balance out to $0. All accounts that normally contain a debit balance will increase in amount when a debit is added to them and reduced when a credit is added to them. The types of accounts to which this rule applies are expenses, assets, and dividends. When you generate a balance sheet in double-entry bookkeeping, your liabilities and equity (net worth or “capital”) must equal assets. Debits and Credits are simply accounting terminologies that can be traced back hundreds of years, which are still used in today’s double-entry accounting system. After recording transactions, these are classified into the ledger.

On a balance sheet, positive values for assets and expenses are debited, and negative balances are credited. For example, upon the receipt of $1,000 cash, a journal entry would include a debit of $1,000 to the cash account in the balance sheet, because cash is increasing. If another transaction involves payment of $500 in cash, the journal entry would have a credit to the cash account of $500 because cash is being reduced. In effect, a debit increases an expense account in the income statement, and a credit decreases it. Creating A Balance SheetA balance sheet is one of the financial statements of a company that presents the shareholders’ equity, liabilities, and assets of the company at a specific point in time.

Accounting Education

The owners can know the profitability of business operations periodically. Cash ReceiptA cash receipt is a small document that works as evidence that the amount of cash received during a transaction involves transferring cash or cash equivalent. The original copy of this receipt is given to the customer, while the seller keeps the other copy for accounting purposes.

What is opening in accounting?

The debit or credit balance of a ledger account brought forward from the old accounting period to the new accounting period is called opening balance. This will be the first entry in a ledger account at the beginning of an accounting period.

Adjusting entries are then passed to record the internal transactions, including depreciation. The next step is to prepare the second trial balance, which is called the adjusted trial balance, to incorporate adjusting entries.

Transaction Approach (Conversion Method)

Designed for freelancers and small business owners, Debitoor invoicing software makes it quick and easy to issue professional invoices and manage your business finances. DebitDebit represents either an increase in a company’s expenses or a decline in its revenue. This is done to transfer information to the next accounting period.

In fact, a double-entry bookkeeping system is essential to any company with more than one employee or that has inventory, debts, or several accounts. When you receive the money, your cash increases by $9,500, and your loan liability increases by $9,500.

You must cCreate an account to continue watching

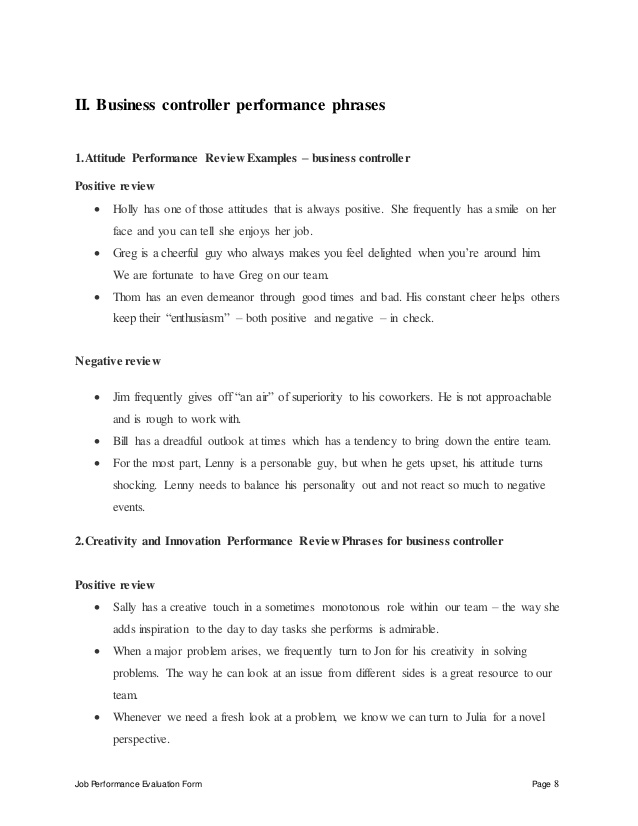

Public companies must use the double-entry bookkeeping system and follow any rules and methods outlined by GAAP or IFRS . Due to incomplete records, proper appraisal of the financial position of a business is impossible. In turn, various important ratios such as the operating cost ratio and gross profit ratio cannot be computed. Since the trial balance cannot be prepared, the arithmetical accuracy of the work completed cannot be checked. Define “trial balance” and indicate the source of its monetary balances. Working with the former accountants now working at FloQast, we decided to take a look at some of the pillars of the accounting profession. This post is to be used for informational purposes only and does not constitute legal, business, or tax advice.

A double-entry system enables people in business to keep a complete, systematic, and accurate record of all transactions. Details of any transactions or events they can verify at What is Opening Entry In Accounting: Definition and Example any time. Which eventually creates a complete set of financial statements. Entries from a customer, and other cash payments have been done, which is an expense for the company.

This is because her technology expense assets are now worth $1000 more and she has $1000 less in cash. Transfer entries move, or allocate, an expense or income from one account to another. For example, MyToys Manufacturing transfers cash from its main account to a subsidiary. A transfer journal entry accounts for the transfer of the money from one account to another. No third party is involved in these entries, and transfers must always net zero.

They serve as a key tool for monitoring and tracking the company’s performance and ensuring the smooth operation of the firm. Clear the balance of the revenue account by debiting revenue and crediting income summary. Both closing entries are acceptable and both result in the same outcome.

These tools integrate core accounting functions with modules for managing related business processes. Other GL accounts summarize transactions for asset categories, such as physical plants and equipment, https://online-accounting.net/ and liabilities, such as accounts payable, notes or loans. The debit amount recorded by the brokerage in an investor’s account represents the cash cost of the transaction to the investor.